Archives-News

Please click here to see the clarification from Corporate Office: :mrs-for-fp.jpg

Please click here to see the order from BSNL CO: mrs-validity.pdf

With great sorrow, we report sudden demise of Com. P. L Hirpara, our Circle Secretary of Gujarat Circle on 24-10-2021 after a short illness. 80 years old Com. Hirpara was admitted few days back in hospital with breathing problem. He was taken to the ICU two days before his death.

CHQ express its deep condolences on the sudden demise of Com. Hirpara.

.........................................................................................

DOT has issued a fresh clarification on the eligibility of BSNL/MTNL Pensioners for CGHS

Please click here to see the ordercghs-om-08-09-2021.pdf

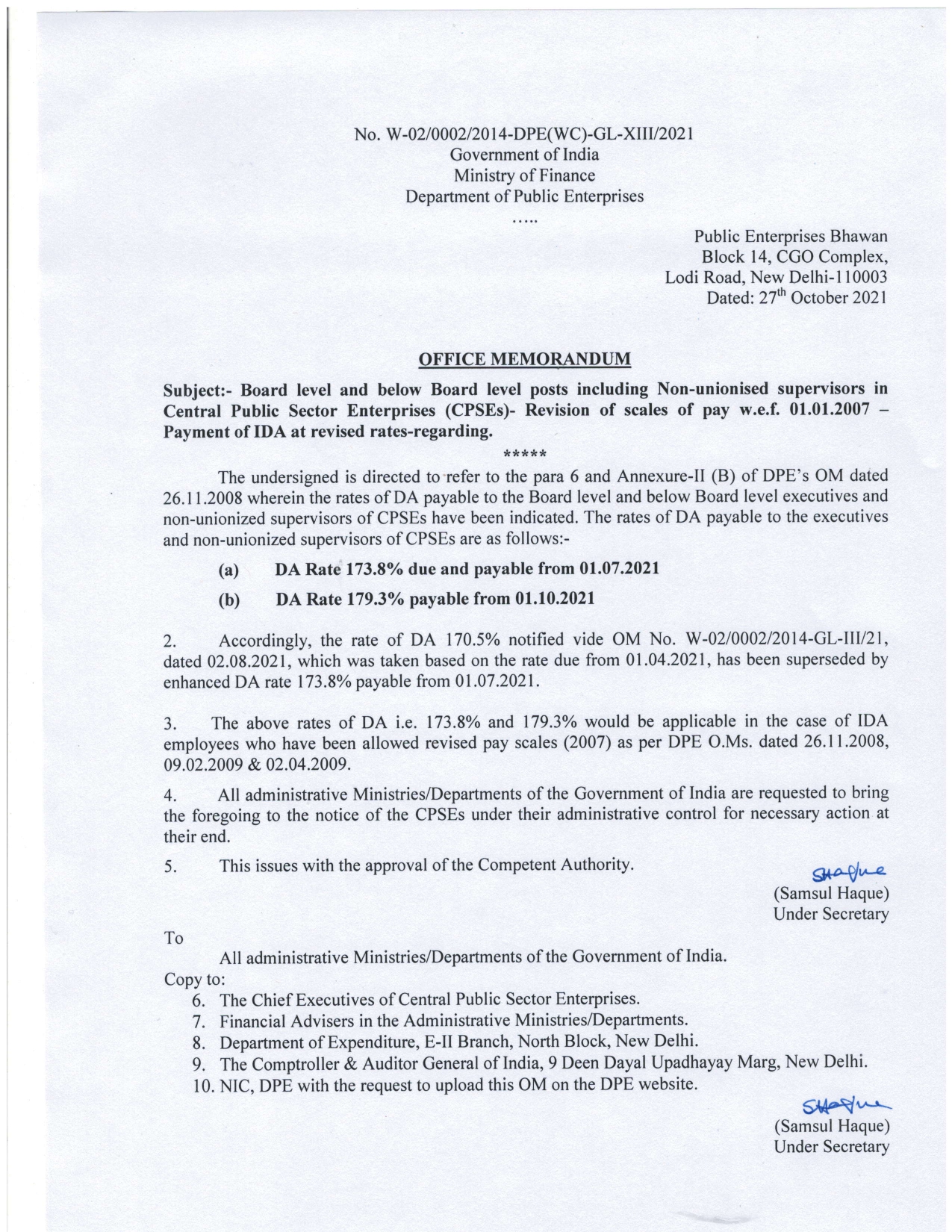

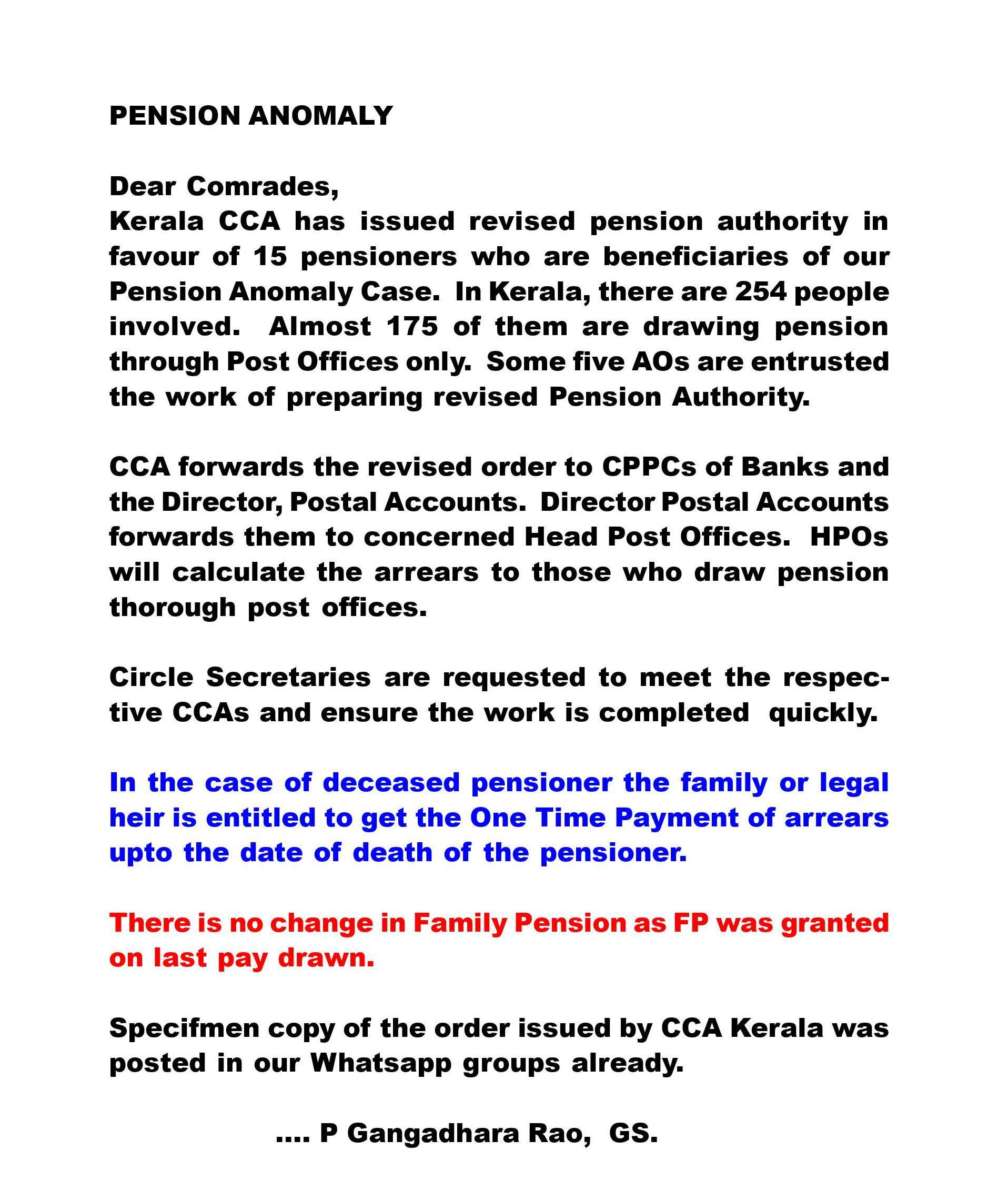

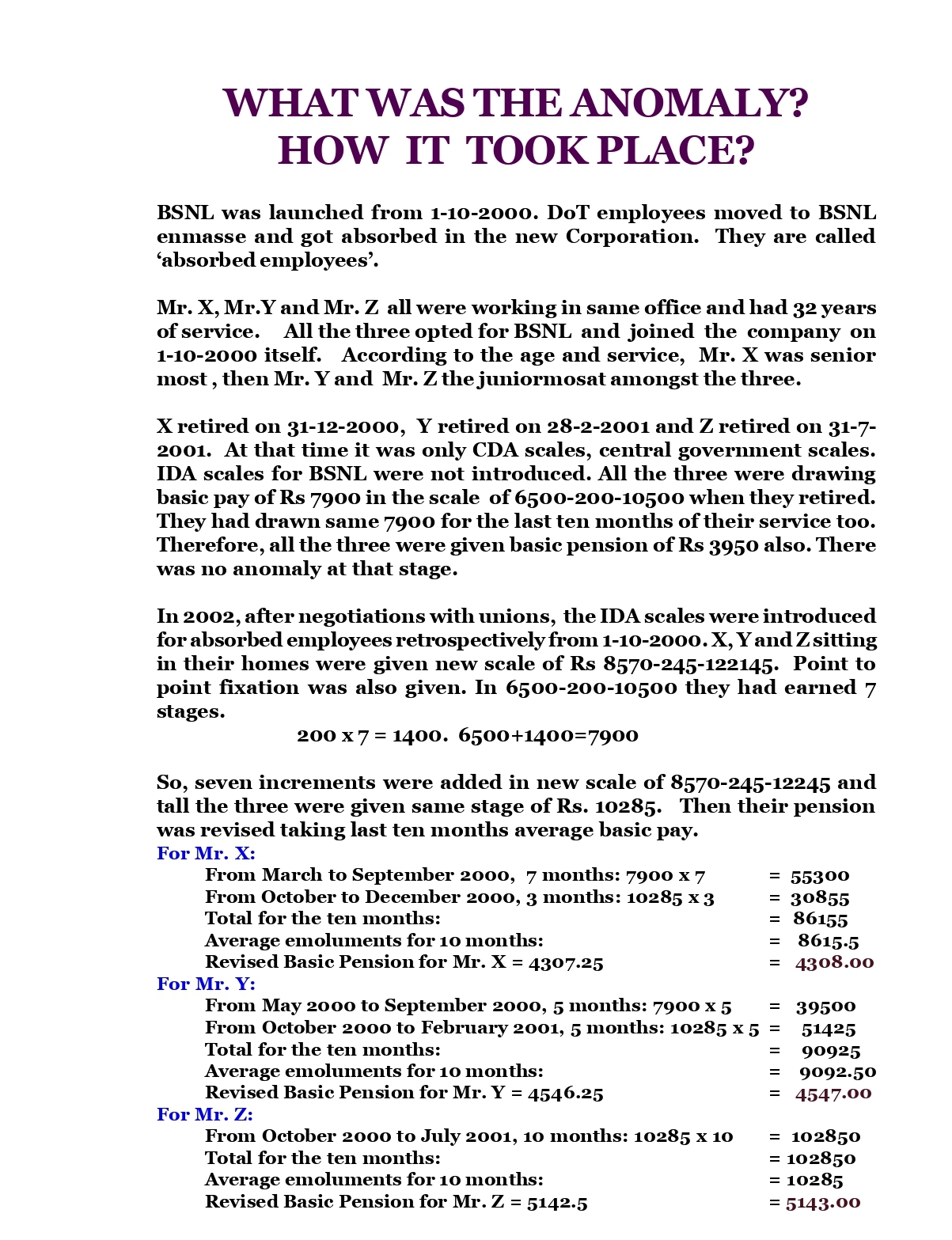

The CCAs have started forwarding revised Pension Authority, revising the pension of beneficiaries of our Pension Anomaly Case, in accordance with the DoT order dated 7-10-2021. The arrears have to be calculated by Banks and Head Post Offices. The letter from CCA Kerala shows 1. BASIC PENSION GRANTED FROM DATE OF RETIREMENT UP TO 31-12-2006 AND ITS NEW REVISED FIGURE 2. BASIC PENSION FROM 1-1-2007 UP TO0 9-6-2013 AND ITS NEW REVISED FIGURE. 3. THE REVISED BASIC PENSION GRANTED FROM 10-6-2013 ONWARDS AND ITS NEW REVISED FIGURE. Below please find a link for a READY RECKNOR containing 9 Tables. Select the Table based on date of retirement. Type existing basic pension granted up to 31-12-2006 (replacing 5000 in Red colour). Then type type new basic pension now revised replacing the figure 6000 shown in Blue colour. Click on the LINK To get Total arrears. ready-recknor-for-anomaly-arrears.xls

LACK OF UNDERSTANDING

Com K Jayaraj, GS, AIBDPA has issued a lengthy circular to celebrate 13th foundation day. He has every right to give such a call. He has claimed that every achievement is because of AIBDPA. But pensioners know the truth.

He has given some incorrect and false information. I want to put the record straight.

TUI (P&R)

Formation conference of TUI (P&R) was held in February 2014 and not 2013.

Com VAN attended that conference on behalf of CITU and not AIBDPA.

AIBDPA was not affiliated to TUI (P&R) then in 2014.

OUR ANOMALY CASE

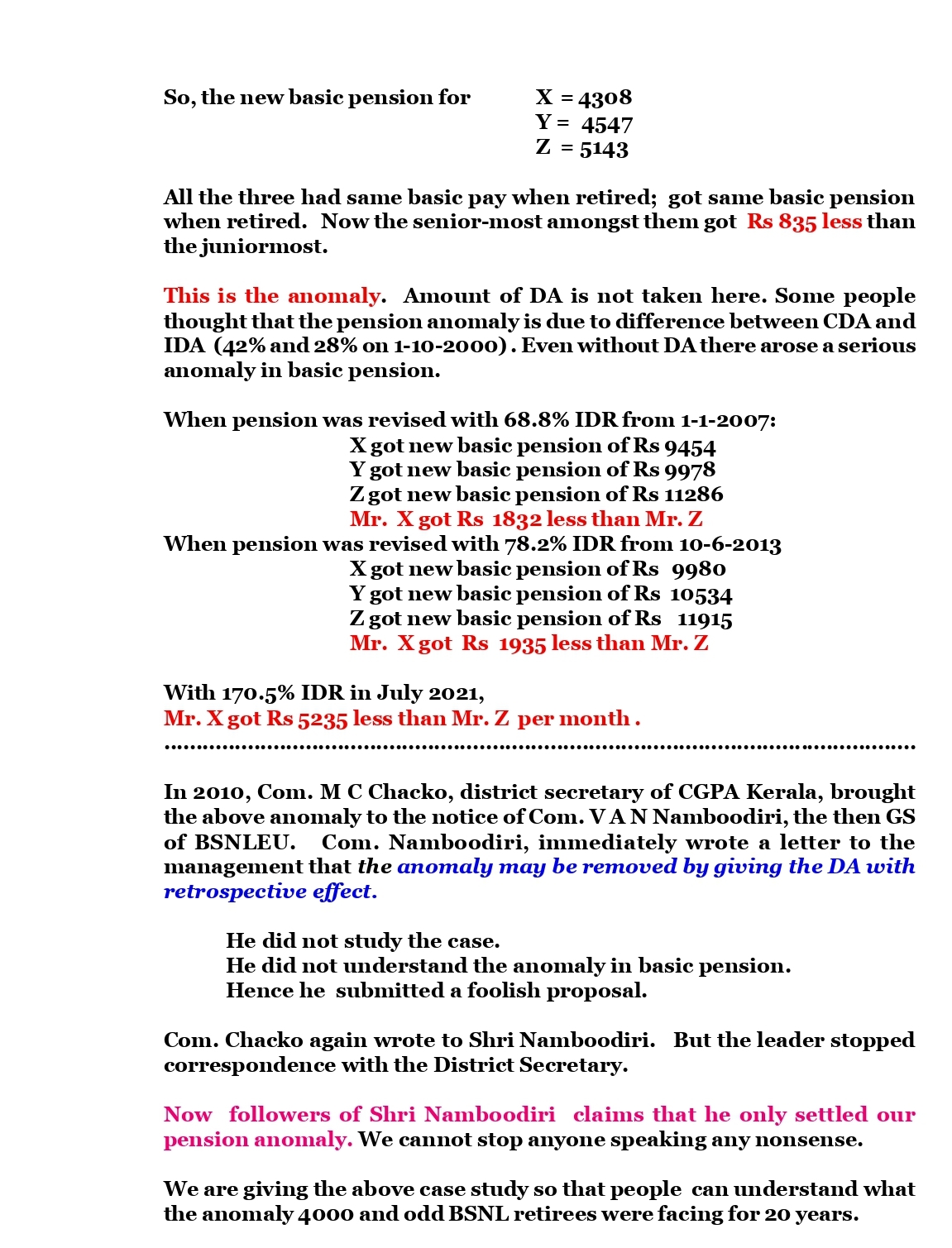

Regarding Pension anomaly case, without knowing the facts he has given wrong information. The rule that In no case pension should be less than 50% of minimum of corresponding revised pay was available even in 1998 as per DoP&PW order. Even before 2011 order, that benefit was given in 2003 itself. For example Com. R Ranganathan of CTO, Chennai and Com. G R Dharmarajan of Madurai got their pension at Rs.4285/- ( 50% of IDA pay of 8570) before the so-called 2011 order.

Recent DoT order is not based on Supreme Court order as mentioned by Com Jayaraj but based on CAT order. He is trying to portray a picture that because we have filed a case they could not settle.

It is a big joke.

We filed the case only in May 2014. The issue of anomaly was there since 2002. BSNLEU was the only recognised union for many years and AIBDPA was working with them in tandem.

Why they could not settle between 2002 and 2014?

I stop with this and I don’t want to expose their lack of understanding on the issue.

D Gopalakrishnan, Vice President, AIBSNLPWA

.....................................

LONG PENDING PENSION ANOMALY SETTLED

ORDER ISSUED TODAY

ANOTHER FEATHER ON THE CAP OF AIBSNLPWA

:

TAXATION ON CGHS REIMBURSEMENT AND DCRG

Corporate office issued a clarification regarding taxation on payment to retired employees on 22/9/2021. Immediately our association wrote a letter on 23/9/2021 itself mentioning the relevant rules and asked for issuing necessary corrigendum.

Yesterday, 4/10/2021, our AGS Com Anupam Kaul met the AGM (taxation) in corporate office and discussed. As per our AGS request, our Vice President Com DG also spoke to that AGM over phone. First reaction from him was that no other organization has raised any objection to the letter.

The AGM informed them that:

“Tax concession can be availed under 80d of IT Rule for CGHS contribution…….Gratuity payment after retirement is not taxable and the clarification is for the payment to legal heirs only”.

Our comrades requested him to issue necessary corrigendum, AGM agreed to consider.

Please click here to read the letter ... letter-to-fm.pdf